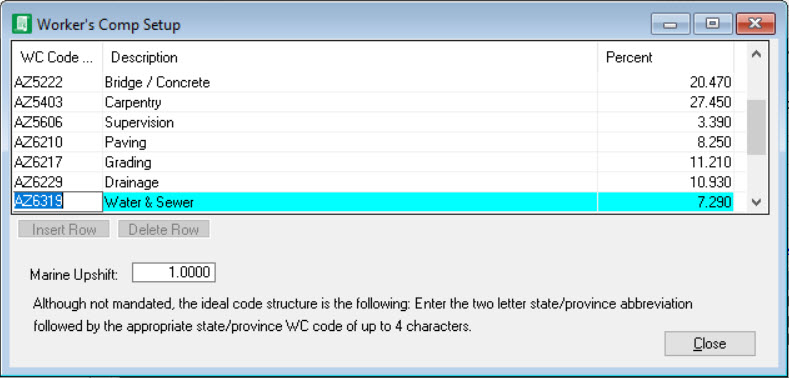

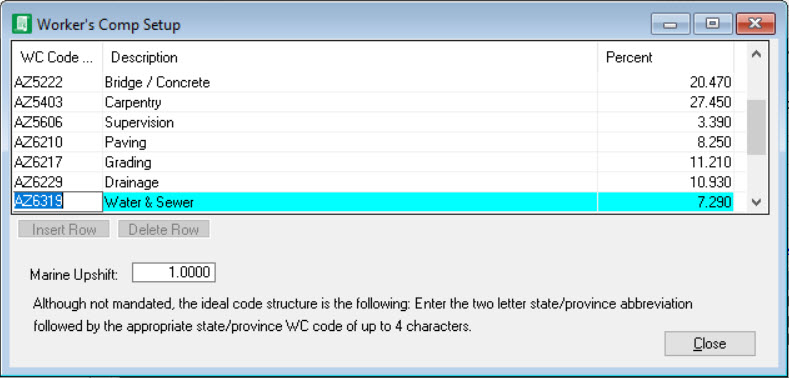

Why setting up the workers comp option in HeavyBid is important

Where do you have the workers comp percentage? I find some companies put the workers comp percentage as part of the labor taxes in the labor setup. Not that this is incorrect, but they might not be aware of the cost ramifications to this setup. If your state(s) calculates workers comp on straight time wages then when an overtime calendar is used, the gross wages are multiplied by the labor tax. The consequence is that you are getting more cost than you need in the estimate. Also consider that most insurance companies actually look at what type of work the craft performs and not the title of the craft. So if the workers comp is part of the labor tax it is difficult to change the percentage for different type of work for HeavyBid Activities. This is what I suggest. First meet with your accounting department rep and ask these questions:

1. How is the workers comp rates levied on field labor?

2. When are the rates revised?

3. Are the rates craft specific or are they based on type of work performed?

I find many times accounting departments do not fully understand the connection between estimating and accounting and they tend to want to simplify the workers comp rate for estimating purposes. Recently I trained a company that had the workers comp in the labor tax and on a recent estimate when we made the correction the total corrected method of calculating workers comp lowered the bid price by over $75,000. A sizeable amount. A more accurate estimate allows for greater confidence in the final bid amount. If you do have the workers comp percentage as part of the labor taxes start a conversation with accounting and management.