Part I – Allocating G&A Expense in HeavyBid

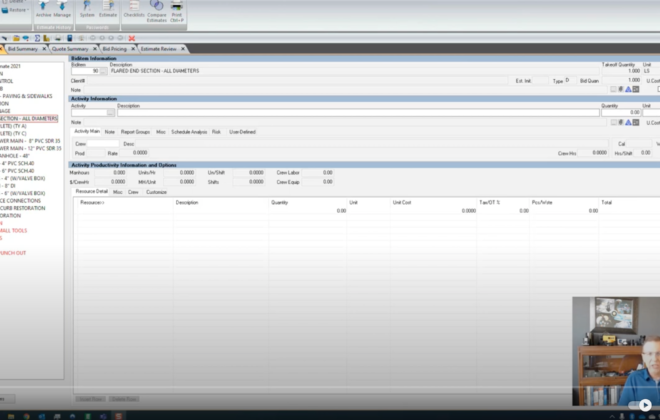

One subject I always introduce in my HeavyBid training is separating markup and G&A (general and administrative expenses). Every company should know what their total overhead expenses as a percentage of total sales or some other measurable cost like yearly total labor. If you don’t don’t your overhead then you don’t know what to markup an estimate. G&A typically covers all the office salaries, office rent, insurance, vehicles not assigned to projects. I call it “the big Nut”. I have seen estimators markup their projects 6% and they probably have a G&A percentage of at least 8%. They are paying to do the project with a -2% deficient. If you are running a full construction accounting software (not Quickbooks) then the overhead can be allocated to each project so you can evaluate true income versus expense on the project. Another reason an estimator should separate G&A from markup is it establishes a budget amount for overhead allocation. If the accounting department over allocates overhead then at least you have an argument as there was a budget amount based on what the estimator was instructed to put for G&A. In the next blog I will cover options on how to calculate G&A in HeavyBid.

For more information in calculating G&A Foundation Software has an excellent article that goes into more detail on the accounting side. Highly recommended to study this. LINK