How to Calculate Unemployment Tax Rate

Most estimators have never run payroll before so when they go to set up their state’s unemployment rate in HeavyBid they, of course, ask their Accounting department for the rate. But what the accounting department usually fails to tell them is that there is a ceiling on each employee. In Florida, it is $7,000. In Wisconsin, it is $14,000. Each state is different. If you keep that employee for the rest of the year you don’t pay unemployment on them but if you have a new hire anytime in the year you start over until the ceiling is reached. So obviously if you put in the state’s full rate then you are overstating the tax amount for the estimate unless you turn over field employees before they reach their earning ceiling. So how does an estimator determine unemployment tax for an estimate? First, get with the accounting department and ask them for the following:

Total state unemployment payment for the last 3 years (by year)

Total unburdened payroll for the last 3 years (by year) – field labor only. Don’t include office personal since that is part of overhead

Then the calculation is easy and remember it is an estimate!

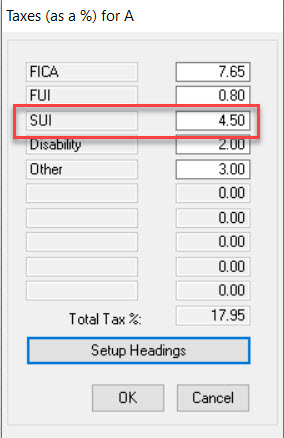

Unemployment Tax Rate = Year Unemployment Payment / Unburdened Payroll x 100

I would do this by year and look at the trend. Err to the high side or take an average. The goal is not to overstate unemployment dollars in the estimate.