What? You don’t know your Overhead %?

I don’t think there are too many more important numbers any construction company should know the company’s overhead percentage. Comes right after your birthday and wedding anniversary. In my trainings, I have seen the estimator put an 8% markup on the estimate and I know their company overhead is above that. You don’t want to give away work but that is what you are doing if you don’t cover your overhead. Stop what you doing before the Fall hunting catalogs start coming in (a distraction) and calculate that percentage!! Here are some suggestions:

- First ask your CPA what the percentage is and what it is based on. Most likely it will be a percentage of revenue, probably last year’s.

- Develop a spreadsheet that details your company’s overhead if you own a fairly small company (less than $10 million per year revenue). Confirm your number with your accountant.

- Purpose to cover your overhead with your projects moving forward. Project revenue (or whatever your basis will be) and start tracking the portion of each estimate that the company overhead allocation. If you don’t cover overhead by the end of the year then you just eating into your profit.

- Monitor your company’s overhead so that you are prepared to pivot if the construction market goes south.

- Be sure you are not double-dipping between project indirects and company overhead. For example, don’t cover the project manager in both. The spreadsheet will help you catch this type of mistake.

Foundation Accounting software had a great article on overhead allocation. LINK

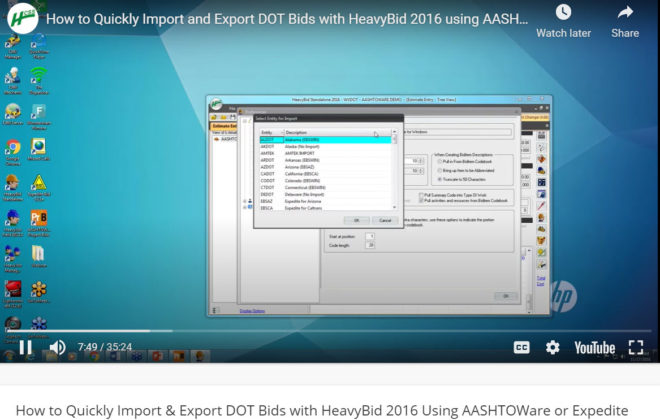

I know everyone uses a spreadsheet but I just had this idea. Why not create a HeavyBid estimate with all these costs? Then it is easily accessible and you will not have mistakes in the formulas. Brilliant.

I will post more on this subject in the future.