Outside Rent – Hidden Costs

I was setting up a new customer this week, and part of this process is setting up equipment. When a vendor invoices for equipment, sales tax is usually added but that is not all. Here are the additional charges that the customer added to the monthly rental fee

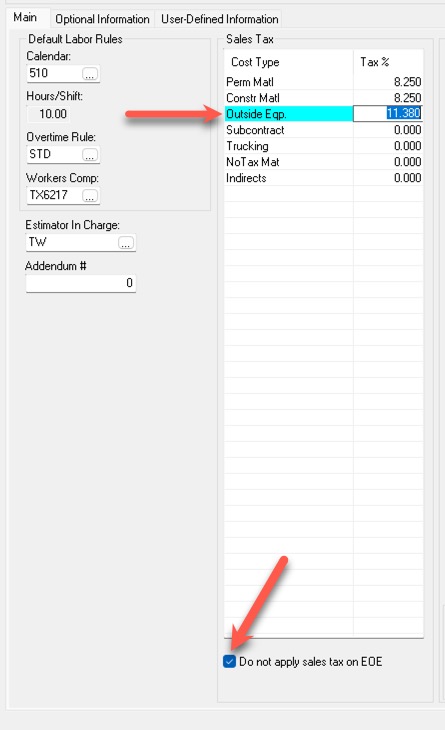

- City Tax = 0.13%

- Surcharge = 1.5%

- State Sales Tax = 6.25%

- Local Sales Tax = 2.00%

- Environmental Fee = 1.5%

Total of above was 11.38%.

My recommendation is to get some invoices and see what the added charges are over the rental quote by time period. I would just put it in the sales tax percentage to be visible to the estimator. Be sure to check the box at the bottom for “Do not apply sales tax on EOE” as the rental company does not usually provide expenses such as fuel.

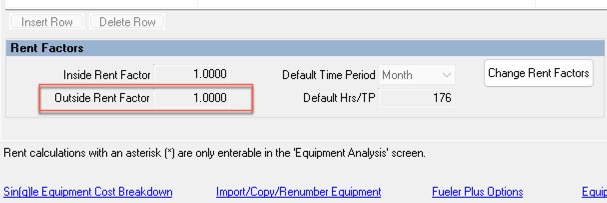

Another option is to apply an Outside Rent Factor in the Rent tab under equipment setup. I would probably do it in Tax or the Rent tab but not split it up.