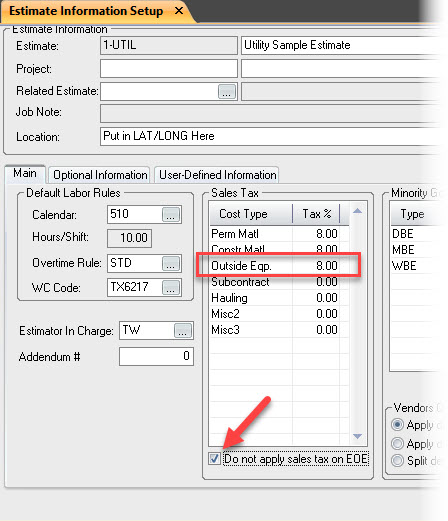

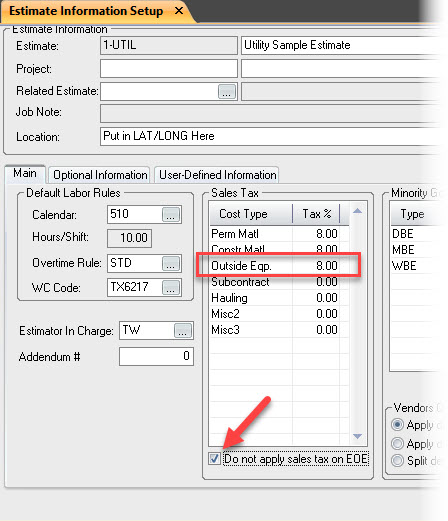

Outside Equipment EOE Tax Setting

I see this quite a lot at companies I visit have equipment designated as “Outside” in the setup. This is a great feature in HeavyBid so that in Summary you can see the total cost for the Outside Equipment. When equipment is rented from a rental company there is always sales tax applied (unless there is no sales tax in your state). The obvious setting is to put sales tax on Outside Equipment in the Setup>Estimate Information screen. But what is often forgotten is on the same column a checkbox for tax on EOE. If the box is unchecked then sales tax listed for the Outside Equipment will be applied to the EOE also which is many cases incorrect. Fuel and other costs usually have sales tax built into the setup values and the majority of EOE costs is usually fuel. Check the box and EOE does not get sales tax applied. I am not saying that the box for tax on EOE should always be checked but it needs to be discussed and analyzed to make sure that sales tax is not doubled up in your estimate.